Optimizing Banking Operations with RPA: Solution Package on Efficiency and Automation

Overview

Icetea Software’s RPA solution automates repetitive banking tasks, enhances operational efficiency, and ensures compliance without disrupting existing IT systems. Designed for seamless integration, it accelerates processes, reduces costs, and optimizes workforce productivity, helping banks improve accuracy, speed, and scalability in their daily operations.

Challenges

Banks and financial institutions face several challenges when it comes to process automation and system integration:

Complex and Disconnected IT Systems

The diverse and complex IT systems used in banking often lack proper integration, leading to fragmented information and inefficient data flow across departments.

High Volume of Manual Tasks

Banks typically handle large volumes of repetitive, manual tasks, especially in areas like accounting, customer management, HR, and IT systems, which consume considerable time and resources.

Difficulty in Streamlining Systems

Integrating and optimizing various systems to shorten processing times and enhance workflow efficiency remains a challenge for many institutions.

Numerous Regulations and Compliance Requirements

Financial institutions must adhere to numerous strict regulations and compliance protocols, often creating additional complexity and making automation efforts difficult to implement seamlessly.

Solutions

RPA is a technology that uses software robots to automate repetitive tasks, typically those that are rule-based and involve structured data. These robots operate through a user interface (UI), mimicking human actions to complete processes 24/7. RPA is designed to work alongside human workers, reducing costs and improving efficiency by automating tasks that are time-consuming and prone to error. It can handle large volumes of data, ensure high accuracy, and significantly reduce operational costs, making it a powerful tool for businesses looking to enhance productivity and scalability.

To address the challenges faced by the banking industry, Icetea Software developed a comprehensive RPA solution tailored to streamline operations without disrupting existing IT systems. The solution offers:

Fast Implementation and Immediate Improvements

The RPA solution can be deployed quickly, delivering immediate process enhancements and results.

Automation and Process Optimization

The solution automates repetitive tasks and optimizes workflows, increasing efficiency and reducing manual efforts.

No Disruption to Existing IT Systems

The RPA solution integrates seamlessly with current IT systems, reducing the risk of disruption or system failures.

Cost-Effective with Quick ROI

With an affordable implementation cost and a rapid ROI (< 6 months), the solution proves to be a valuable investment for banks looking to optimize operations.

Technology & Deployment Infrastructure

To ensure seamless automation and high efficiency, our solution leverages a robust technology stack and flexible deployment options:

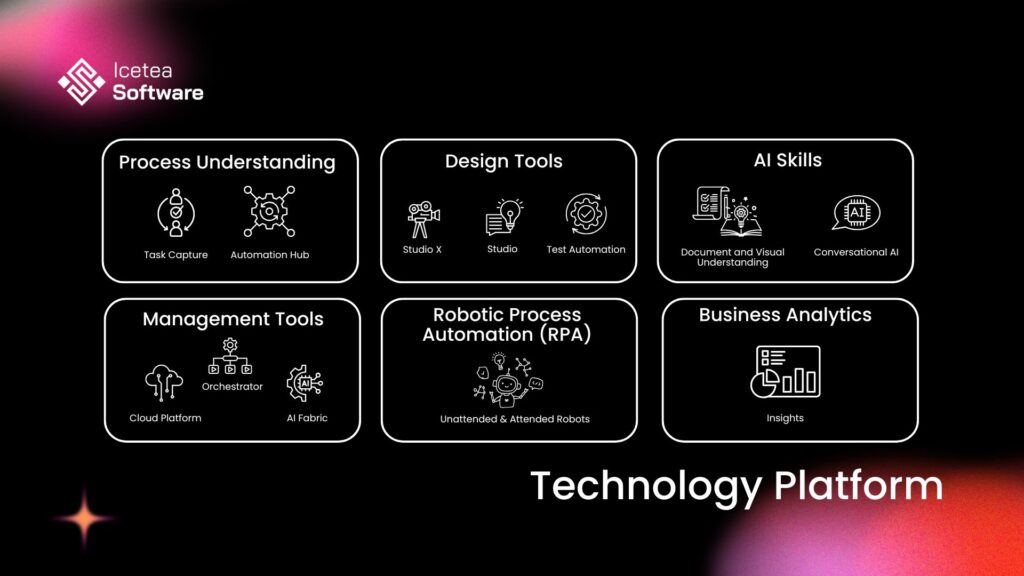

Technology Platform

Our solution optimizes banking operations through integrated automation and AI tools. It includes process analysis with Task Capture, workflow design via Studio and StudioX, and intelligent automation using AI skills. Management tools like Orchestrator and AI Fabric ensure smooth deployment, while attended and unattended RPA handle complex tasks. The Insights module provides analytics to refine performance and strategy.

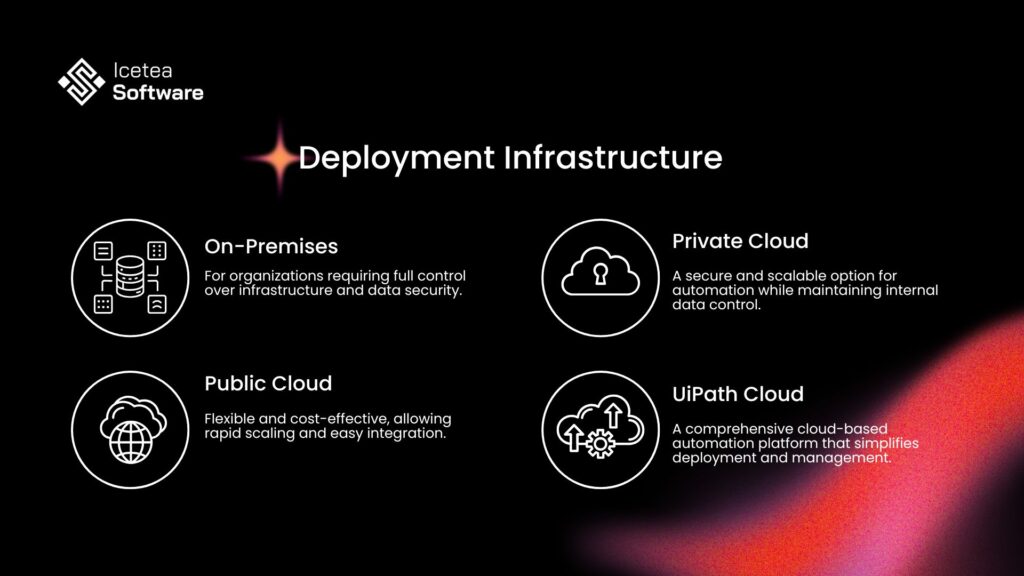

Deployment Infrastructure

Our solution provides flexible deployment options—on-premises, private cloud, public cloud, and UiPath Cloud—ensuring compatibility with diverse IT environments. This unified platform enables secure, scalable automation with seamless system integration and consistent performance to support future growth.

Results & Impact

The implementation of RPA in the banking sector has delivered significant improvements in efficiency and operational performance:

Increased Efficiency

RPA has allowed banks to process tasks faster, with 98% of cases seeing a 600% improvement in processing speed, especially for email-related tasks, handling up to 15 million emails annually.

Time Savings

RPA helped save significant time in various operations, including a 34% reduction in time spent by employees on data processing tasks and 19% time savings when specialized professionals were required.

Cost Reduction

The solution contributed to a 30% cost saving in processing loan requests and a 91% reduction in costs for services handling automation tasks. Additionally, 65% cost reduction was achieved in the banking sector after implementing RPA for over 800 processes.

Increased Workforce Productivity

With RPA, 120 Full-Time Equivalent (FTE) roles were freed up, allowing employees to focus on more strategic tasks and improving overall workforce efficiency.

Enhanced Process Automation

The automation of bank operations saw 70% of repetitive tasks across departments automated, contributing to a significant increase in operational throughput and reducing human error.

Popular Applications

The iBASE IA_Invoice solution can be integrated into several key areas within banking and finance, including:

- Loan Services: Bots automatically check the borrowing history of applicants, make loan decisions, and process loans through real-time transactions, while storing customer transaction data.

- Customer Service: Bots can respond to customer requests and queries (integrated with AI), process loan requests, and update customer profiles.

- Account Management: Bots can assist with account opening, saving accounts, loan applications, and interest management, ensuring a smooth and efficient transaction process for customers.

- Card Management: Bots handle tasks such as issuing cards, processing cases of lost cards, and renewing expired cards or changing card types.

- Customer Information Management: Bots can collect and categorize customer data from various communication channels, input it into centralized systems, and send alerts to relevant departments.

- Data Analysis: Bots analyze data from multiple systems, make decisions based on specific criteria, and recommend actions to improve customer service or processing workflows.

- Transaction Procedures & Verification: Bots can verify loan repayments, process payment requests, and handle processes like loan disbursement, offering a seamless customer experience.

- Reporting: The system can aggregate and analyze data from various administrative systems to generate financial reports, providing valuable insights to help make informed decisions.

About Icetea Software

Icetea Software is a premier blockchain and AI development company specializing in Web3 solutions, decentralized applications, and AI-driven innovations. Our expertise in AI, blockchain, and open-source development ensures secure, scalable, and future-ready technology solutions for businesses looking to thrive in the decentralized era.

Ready to streamline your processes, reduce costs, and boost efficiency with RPA? Contact Icetea Software today to explore how our tailored automation solutions can help your bank achieve greater productivity, compliance, and performance. Let’s work together to enhance your operations and set your institution on the path to success.