Prediction Market Platform Development Cost: How Much Does It Cost to Build Like Polymarket or Augur?

- What Is a Prediction Market Platform? How Does It Work?

- Why Is Blockchain Essential for Prediction Markets like Polymarket and Augur?

- Factors that Drive the Cost to Build A Prediction Market Platform

- Prediction Market Development Cost Breakdown: From MVP to Full-Scale Platform

- Which Technology Stack Is Best for Building a Prediction Market Platform?

- Must-Have Features for a Modern Prediction Market Platform

- How Long Does It Take to Build a Prediction Market Platform?

- Common UX Challenges in Prediction Market Platform Development

- Get a Custom Cost Estimate for Your Prediction Market Platform

- Conclusion

Prediction markets are among the most successful real-world applications of blockchain today. They allow users to trade on future outcomes – from elections and sports to crypto market trends – turning collective opinions into real-time signals. Platforms like Polymarket and Augur have demonstrated how blockchain can enable transparent, open and trustless markets without traditional intermediaries.

For teams planning to build a similar product, one of the first questions is the prediction market platform development cost. How much investment is required to move from an idea to a functional platform? The answer depends on multiple factors, including feature scope, technology choices, and development stages. In this article, Icetea Software team will break down the key cost drivers, timelines and technical considerations involved in building a scalable prediction market platform.

What Is a Prediction Market Platform? How Does It Work?

Let us keep it simple, a prediction market platform is a digital marketplace where users trade on the outcomes of future events. These events can range from elections, sports results, and economic indicators to crypto price movements or industry trends. Instead of placing traditional bets, users buy and sell outcome-based shares, where each share represents the probability of a specific result.

Platforms such as Polymarket use blockchain technology to remove middlemen and keep all transactions transparent and verifiable. Augur is another example, known as one of the earliest decentralized prediction markets built on Ethereum. Both platforms rely on smart contracts to automatically handle trading, payouts, and settlements once an event ends and the result is confirmed.

Behind the scenes, a modern prediction market platform functions much like a decentralized exchange. It includes market creation, liquidity management, trade execution, and automated payouts once an event is resolved. When the final outcome is confirmed, winning positions are settled automatically, and users receive their rewards without manual intervention. This mechanism makes prediction markets not only engaging but also data-driven and efficient.

Why Is Blockchain Essential for Prediction Markets like Polymarket and Augur?

Blockchain is the core technology behind prediction markets like Polymarket and Augur. Instead of relying on a central operator, these platforms use smart contracts to handle trades, lock funds, and distribute payouts automatically. All transactions are recorded on-chain, making the system transparent and easy to verify.

To resolve real-world events, Polymarket and Augur rely on decentralized oracles that bring trusted external data, such as election or sports results, onto the blockchain. Combined with crypto wallets, blockchain enables secure participation while keeping financial flows open and traceable. This trustless design is what allows decentralized prediction markets to operate fairly at a global scale.

Factors that Drive the Cost to Build A Prediction Market Platform

The cost of building a prediction market platform depends largely on its scope, feature set and technology choices. A simple MVP requires far less investment than a full-scale, cross-chain platform like Polymarket or Augur. Below are the main factors that influence the total development cost:

- Blockchain network selection: Different blockchains such as Ethereum, Polygon or Arbitrum come with varying transaction fees, scalability options and development complexity, all of which affect cost.

- Smart contract development and auditing: Developing, testing and securing smart contracts that handle trading, settlement and payouts is one of the most complex and expensive parts of the platform.

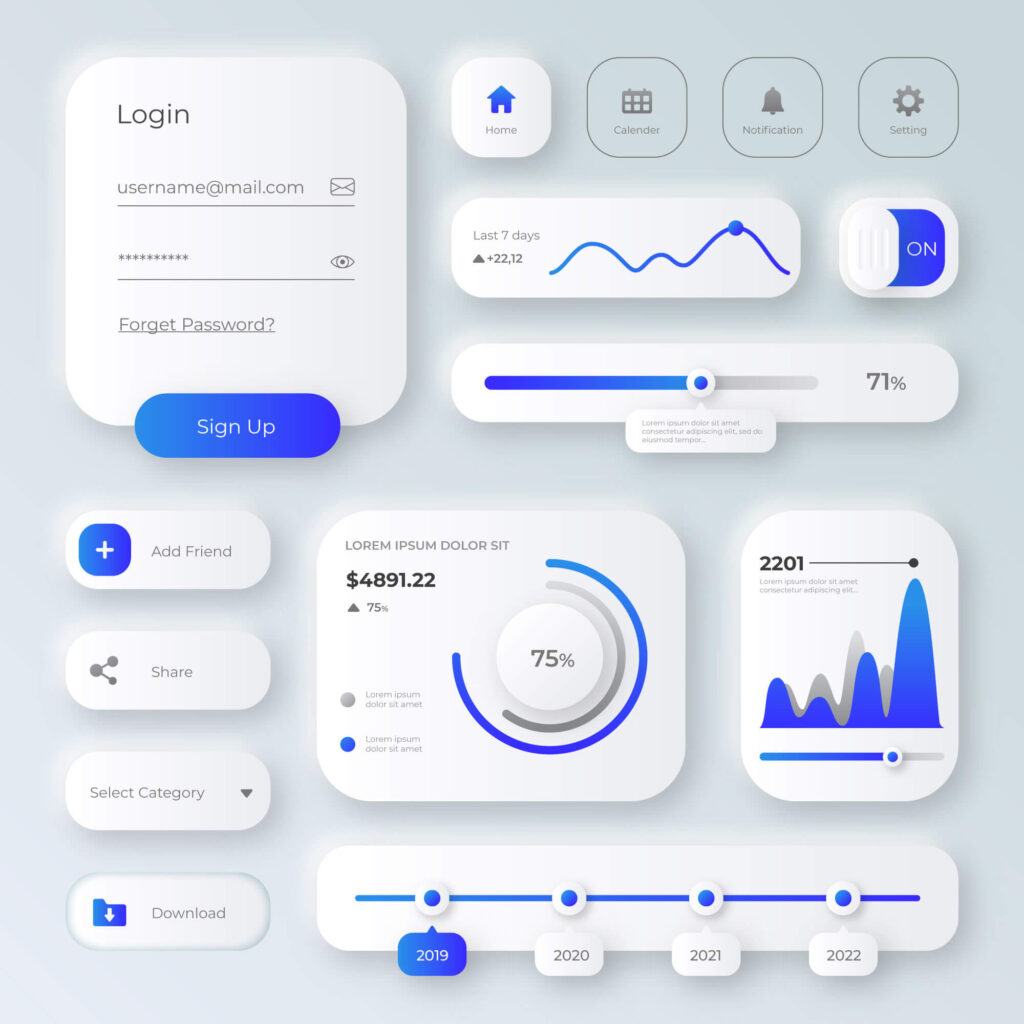

- User interface and experience (UI/UX): Real-time market data, charts and smooth interactions require more development effort and increase overall costs.

- Oracle integration: Reliable data feeds are essential for resolving real-world events and integrating decentralized oracles adds to both development and maintenance expenses.

- Wallet and token support: Supporting multiple wallets, tokens or cross-chain assets increases technical complexity and development time.

- Security audits: External audits are strongly recommended and can account for 15–25% of the total budget.

- Regulatory and compliance requirements: Depending on the target market, features such as geofencing or legal consultation may be required, adding further cost.

All these components play an important role in building a reliable and scalable prediction market platform, and cutting corners often leads to long-term risks.

Prediction Market Development Cost Breakdown: From MVP to Full-Scale Platform

To make cost expectations clearer, prediction market development can be divided into three common stages:

Minimum Viable Product (MVP)

An MVP focuses on validating the core idea with essential features such as basic trading, event creation, wallet integration and automated payouts. With a simple interface and limited blockchain integrations, an MVP typically costs between $40,000 and $70,000.

Mid-Range Platform

A mid-range version offers a more polished user experience, improved performance, oracle integration and broader asset support. Platforms at this stage are similar to early Polymarket-style implementations and usually require a budget of $80,000 to $150,000.

Full-Scale Enterprise Prediction Market

A full-scale platform includes advanced features such as staking, governance mechanisms, multi-chain support, liquidity pools and custom analytics. These systems demand higher security, scalability and performance, pushing development costs beyond $200,000, depending on complexity and customization.

Which Technology Stack Is Best for Building a Prediction Market Platform?

Beyond cost, choosing the right technology stack is critical for building a secure, scalable prediction market platform. You do not need deep technical expertise but understanding the basics helps you make smarter product and budget decisions.

Most prediction market platforms start with Ethereum because of its security, mature ecosystem and strong smart contract tooling. At the same time, newer networks like Polygon, BNB Smart Chain and Solana are gaining adoption thanks to lower transaction fees and faster processing.

A typical technology stack includes:

- Frontend: React.js, Next.js, or Vue.js for responsive, real-time trading interfaces

- Backend: Node.js or Python (Flask, FastAPI) for off-chain logic and analytics

- Smart Contracts: Solidity (Ethereum), Rust (Solana), or Vyper

- Data Storage: IPFS or Filecoin for decentralized storage; MongoDB or PostgreSQL for off-chain data

- Oracles: Chainlink, API3 or custom oracle solutions for event verification

- Wallet Integration: MetaMask and WalletConnect

- Infrastructure & Hosting: AWS, Infura or decentralized infrastructure providers

For platforms targeting advanced features like multi-chain support, staking or governance, working with an experienced smart contract development team is essential. A reliable blockchain development partner ensures smooth integration of smart contracts, oracles and UI without sacrificing performance or security.

Must-Have Features for a Modern Prediction Market Platform

While design and branding matter, a prediction market platform can only succeed if it delivers the right functionality. By today’s standards, there are several features that users and investors expect as a baseline.

Core features focus on usability and trust:

- Non-custodial wallet onboarding, allowing users to connect via crypto wallets without giving up asset control

- Market creation and participation, enabling users to create or join prediction pools

- Smart contract–based escrow and payouts to automate settlement once outcomes are verified

Live price charts and liquidity tracking to show real-time probabilities - Multi-token support, including stablecoins for trading and payouts

Advanced features help platforms scale and compete:

- Governance tokens and staking mechanisms for community-driven decision-making

- Layer 2 or multi-chain support to reduce transaction fees and improve performance

- Decentralized oracle integration for secure and transparent event verification

- Advanced analytics dashboards showing volumes, probabilities, and user activity

- Liquidity incentives, such as market-making rewards or liquidity mining programs

It’s important to note that adding advanced features significantly increases the overall prediction market platform development cost with DAO governance and staking systems among the most complex components to build.

How Long Does It Take to Build a Prediction Market Platform?

Once cost, features and technology choices are clear, the next key question is the development timeline. Building a prediction market platform involves multiple phases, each contributing to the final delivery schedule.

A typical timeline looks like this:

| Development Phase | Key Activities | Estimated Time |

| Discovery & Planning | Requirements analysis, architecture design, compliance review | 2–3 weeks |

| Smart Contract Development | Market logic, trading rules, payouts, security design | 6–8 weeks |

| Frontend & Backend Development | User dashboard, admin panel, APIs, data handling | 8–10 weeks |

| Oracle & Wallet Integration | Event data feeds, wallet connections, transaction flows | 6–8 weeks |

| Testing & Security Audits | QA testing, smart contract audits, performance checks | 4–6 weeks |

| Deployment & Launch | Mainnet deployment, monitoring setup, go-live | 1–2 weeks |

Estimated total timeline:

- MVP platform: ~4–6 months

- Full-scale platform: ~6–9months

- Enterprise-grade platform (DAO, multi-chain): ~10–12 months

This phased approach helps Web3 startups and enterprises manage risk, control development cost and scale features over time.

Common UX Challenges in Prediction Market Platform Development

Even with a strong blockchain backend, a prediction market platform succeeds only when users find it easy to use. Early platforms like Augur struggled with complex interfaces and slow interactions, while newer solutions focus heavily on clean UI, fast performance, and mobile-friendly design.

Frontend development—such as dashboards, live charts, and data visualization—can account for 20–30% of the total prediction market platform development cost. Smooth onboarding, simple wallet connections, and clear transaction feedback are critical to driving user adoption.

To reach a wider audience, many teams now use cross-platform frameworks like React Native and simplify wallet usage and gas fee handling. These UX improvements reduce friction, improve retention, and make prediction markets accessible beyond crypto-native users.

Get a Custom Cost Estimate for Your Prediction Market Platform

Every prediction market idea is different, and so is its development cost. Features, blockchain choice, UX complexity, and compliance all play a role in the final budget.

At Icetea Software, we help Web3 startups and enterprises turn ideas into scalable prediction market platforms with clear scope, transparent pricing, and no hidden costs. From MVPs to full-scale platforms like Polymarket or Augur, our team delivers secure blockchain development and smooth user experiences.

Talk to Icetea Software to get a custom cost estimate and expert guidance for your prediction market project.

Conclusion

Building a prediction market platform requires the right balance of blockchain technology, intuitive UX/ and smart cost planning. With the right development partner, you can reduce risk, accelerate time-to-market, and launch a secure, scalable prediction market platform that users actually want to use.

————————————————————————

Icetea Software – Prediction market platform development cost

Website: iceteasoftware.com

Linkedin: https://www.linkedin.com/company/iceteasoftware/

Facebook: https://www.facebook.com/IceteaSoftware/

Twitter: https://x.com/Icetea_software